Mar 9, 2018

Mar 9, 2018

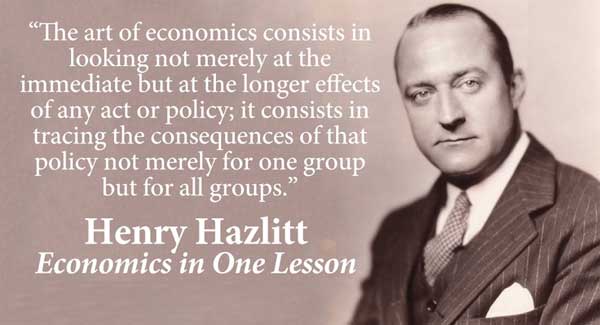

Economics in One Lesson

a libertarian short introductory book about economics for beginners (but don't let this over-simplification fool you - this is a powerful book with over 10,000 entries in its bibliography)

Author: Henry Hazlitt

ISBN: 0517548232

Genre: Economics

Pages: 218 pages

Country: United States

Publisher: Harper & Brothers

Publication date: 1946

OCLC: 167574

Rating:

![]()

![]()

![]()

![]()

![]() (5 out of 5 stars)

(5 out of 5 stars)

Foreword

THIS BLOG IS A LONG READ!!! I practically summarized the book - which is more than a book review. This is my own personal way to ensure I understood and will retain what I read. By doing this, I also make this blog a reference for future use.

This is not a fast read. I read a sentence, let it sink in, making sure I understood what was being said, before proceeding to the next sentence. At this pace, I could only cover 1 chapter per reading. And only then will I write my summary of that chapter, plus my thought bubble in this blog. Yes, it is slow reading, but it is definitely quality reading.

I first heard about this book, Economics in One Lesson, while listening to an interview by Jason Burack of Roger Ver in Wall Street for Main Street Youtube channel. They described the book as an indispensable eye-opener so I decided to look it up.

If you are just as confused as I am about economics and everything else that has been written about it, make this your next read. It was written back in 1946 but it remains just as relevant and compelling as today's headlines. This is a timeless classic!

Micro vs Macro Quandary

I'm not sure if this quandary has been since resolved, but as an elementary student, my economics teachers taught us that Micro and Macro Economics both work and exist in society at the same time, but there is no one unifying equation that explains them both - they can only be explained individually. It's a lot like the Relativity vs Quantum Mechanics - until 1984, they could not be both explained in one mathematical equation without the anomalies.

Market Meltdowns

Another economic mystery to me were market crashes. Again, the economics books during that time simply said that this phenomena cannot be explained - they just happen. I began to suspect that no one really knows economics - the so called experts simply give their authoritative speculation - not fact, but speculation.

Zeitgeist

It was not until watching this mind-awakening documentary, Zeitgeist, that I got another insight that the entire economic system is rigged - so the powers that be, try as much as they can to muddy-up economics, like it's some kind of complex discipline only a few learned people truly understand - and that the economic job is best done by them. This is perhaps the best explanation I ever got about economics that made any sense at all. But I was still left in the dark about economics. Over simplifying it to supply-and-demand simply didn't cut it.

Government Spending and Your Money

With all the confusing talk from everyone who has an opinion about government spending and taxes, Henry Hazlitt cleared the cobwebs by presenting an immutable constant:

Government spending comes from taxes they collect from you. Even if the government loans the money by floating bonds, they still need to pay for that loan and the money still has to come from taxes you pay. If government prints money from out of thin air, it results in inflation which erodes your purchasing power and consequently is a form of a vicious tax. Ultimately, you pay for what the government spends - there is no free meal.

Building a Bridge

Public works or government spending (e.g. - a bridge) is largely seen favorably as a net gain for everyone because:

- bridge construction creates jobs

- the public see a physical infrastructure - the bridge, so they see where their taxes went

- the public actually benefit from the use of the bridge

Henry Hazlitt contends that even in a perfect world when there is no corruption in play in constructing the bridge, it is not as rosy as what the politicians would have you believe.

First of all, he contends about the purpose of the bridge. Why is the bridge being built in the first place? If it is to decongest a serious traffic problem, then that's ok - the bridge needs to be built. But what if it was being constructed simply to provide employment? Is it ok for the government to take away your money so that it can offer someone a job?

Second, did it really create jobs? Sure, you see construction workers, engineers, foremen working on the bridge. But do you see the resulting job loss? None? There is a loss but you don't see it because it never had a chance to happen. How? Henry explains it lucidly. If you planned on buying a car with your money, but the government took your money away in a form of tax to pay for the bridge, then you have no money left to buy that car, no? With that, the car manufacturer was not able to sell that car which consequently resulted in a job loss to the car worker. In short, the job creation for the bridge worker resulted in a job loss to the car worker. But you don't see the job loss because what you see is the bridge - not the car that could have been bought. At the end of the day, there was no net gain from the bridge - only a diversion of money from one industry to another.

Taxes Discourage Production

When you lose, you lose 100 cents on the dollar. When you win, you pay 60 cents in taxes, which leaves you only 40 cents on the dollar. You work for the government for 5 hours and only work for you and your family for 3 hours in an 8-hour work day. Instead of investing your 100 cents of gain for further productivity, you end up with only 40 cents (because the 60 went into taxes) which leaves a smaller amount for production. Taxation is not incentive to be productive.

Credit Diverts Production

Government credit to farmers are viewed as populist. But it has 2 short-term considerations:

- it only focuses on the farmers and not to more deserving parties who are in a better position to pay for that credit

- it only considered the first half of the transaction - and not extend to his ability to pay or the consequences of his inability to pay

When government extends credit to a farmer, it means that the likelihood of the credit being repaid is not as good as when the private sector is extending that credit, because the private sector (banks) has tighter restrictions in lending than government. If that credit is not paid, then the taxpayer loses because that was his money.

When government makes loans or subsidies to business, what it does is to tax successful private business in order to support unsuccessful private business. Why? Because government funds all come from taxes - your money.

The Curse of Machinery

Machineries create unemployment? History showed us that a technological progress create more opportunities and ultimately create more jobs. There is also the unseen section. e.g. - a bike manufacturer gets a new machine that doubles the production of bikes in the same length of time, so he lays off half his workers and still get the same bike output. So, half the work force was laid off! What is not seen is that people were also hired to manufacture and maintain this new machine. Additionally, the business owner, after the machine has paid for itself, starts generating higher profits which go to buy more machines, increase his consumption or reinvest in other industries - all of which increase employment. His competitors will also buy this new machine and increase employment to the machine manufacturer. At some point, when bike manufacturers get this machine, price of bikes go down which generates savings to the consumer who uses this savings for consumption which generates employment again. This is a clear case of looking at the long term and looking at other beneficiaries, not just the apparent victims. Technological breakthroughs, inventions, discoveries leading to increased efficiency always turn out better for society in the long run.

Spread-the-Work Schemes

Labor unions are notorious for 'spreading-the-work' to boost employment at a level that can only be viewed as stupid and counter-productive. e.g. - an electrician cannot pry a tile off a wall to do his electrical work - labor law says a qualified tile worker has to do the prying of that one single tile and perhaps even command a day's pay. Sure, 2 people were given employment instead of one, but does it mean it's advantageous to the economy? At the outset, the scenario already looks ludicrous. On something like this, we have to look at the invisible reality. The householder who was prepared to pay $60 for the electrical job now has to pay another $50 for the tile-setter. Originally, that $50 was supposed to buy a coat. Without the $50, there won't be money to buy the coat. This means that the coat maker was denied employment. The coat-maker's loss was the tile-setter's gain, plus the stupidity that came with the equation. There was no net gain. The national wealth remained the same.

Disbanding Troops and Bureaucrats

After a major war, when hundreds of thousands of soldiers return home, there is that great fear that the private sector cannot readily absorb such great number and thus, there will be massive unemployment, right? At least, that is the popular thinking. If the government retains the soldiers using tax payer's money, the money would be for nothing because the soldiers are unproductive - there is no more war to be fought. However, if the government relieves the soldiers to be private citizens again AND stops collecting taxes that should have been used to fund the soldiers, THEN, the tax payers would have more disposable income. They can buy a car which provides employment to the car manufacturers and eventually jobs for the car mechanics. They can have the leak on the roof fixed which provides employment to the roof repair man and roof-material manufacturer. So, by not subsidizing the soldiers, the national wealth increases.

The same argument can be presented to bureaucrats whose service is either redundant or no longer needed. Often, you would have 2 people doing the job of one. By keeping that extra person employed, taxes have to be levied in order for that redundant person to be paid. But the redundant person is not productive thus there is a loss to the national wealth. If this redundant person is fired, no tax is used to pay for his salary, resulting in the tax-payer having more disposable income to spend on consumer goods which increases employment in the private sector. The fired government worker can find work in the private sector where he can be productive and contribute to the national wealth.

Fetish of Full Employment

According to Hazlitt, the goal of society is full production - not necessarily full employment. It is easy to have full employment - build roads and bridges even if not necessary or hire 10 people for the work of one. But full production is more difficult albeit more efficient. How do you utilize all labor-saving mechanism to boost production while keeping the least number of people? If production goal is producing 100 tonnes of rice, is it better to hire 50 farmers to do back-breaking work? Or to hire one farmer who can work on a tractor? The real goal is productivity and not employment - employment is only the means and not the goal.

Who is Protected by Tariffs?

Hazlitt gives an example. An American coat manufacturer, selling coats at $15 goes to Congress to retain a $5 tariff on English coats to increase the British's selling price from $10 to $15, making both coats sell retail at the same price. This in turn will protect the jobs of American coat workers. Without the tariff, American coat manufacturers will shut down and lay-off thousands of workers. This has always been a popular argument in any industry.

But what people see here are just the immediate effects (saving jobs) in one industry (coat industry). They don't see the downside over the long term affecting other industries, simply because they never had a chance to happen - but it doesn't mean that the damage did not happen. So, what exactly are the unrealized benefits of the tariff protection? There are a few scenarios:

- Let us say the tariff was repealed, so British coats sold for $10 while American coats sold for $15. Not long after, American companies closed down and laid-off its workers. This is now what happens next (the invisible benefit that didn't have a chance to happen):

- the American consumer now pays $10 for a coat instead of $15, which gives them a disposable income of $5. This $5 will now be spent on other consumer items which create employment for all industries affected by the increased consumer spending

- because the British now have American dollars, they will now have to buy American goods and services to make use of those dollars. This creates more employment in industries where those dollars are spent - American export is boosted.

- Let us now say the tariff was never there to begin with and British coats were selling for $10 while there are no American coat manufacturers because they cannot sell a coat for $10 - the lowest they can sell it while remaining viable is $15. With the imposition of the $5 tariff on the British, the British now have to sell at $15. Now, the Americans can compete with the British, so this development brings about the birth of the American coat industry. This is now the invisible reality:

- instead of paying for $10, the American consumer now has to pay $15 - this additional $5 is essentially an added tax for the government's subsidy of the inefficient American coat industry. The American public ultimately bears the burden of this tariff.

- true, the new American coat industry brings with it employment for the new coat workers. But it's not really a net gain because the $5 additional money consumers pay for the coat means $5 less to buy other consumer goods - meaning less employment for all other industries outside the coat industry. But people only see the new coat factories and the people it employs - they don't see the resulting shrinkage of other industries brought about by the emergence of the coat industry. In fact, even professional statisticians will find it impossible to identify and quantify the loss from all affected industries.

- if the British can produce the same quality coat for $10 and the Americans for $15, then the American are not efficient in that industry. But with the tariff, the government props that inefficient industry instead of helping an industry where Americans are efficient. Thus, this tariff actually reduces the average productivity of the country's labor and capital.

- with the price increase of the coat, the consumer buys less for his money resulting in reduced purchasing power or reduced real wages

As a general rule, barriers to international trade (tariff, import quota, exchange controls, bilateralism) can only be a bad thing.

Thought Bubble: While this equation is supported by logic, it is a hard-sell at best to the public. Why? If a factory closes down due to tariff repeal, you see the jobless lining up in soup kitchens or be driven out of his home together with his family. How do you explain to the public that the saving you generated from the 'no tariff' helped employment elsewhere when you cannot even point out who the beneficiaries are?

The Drive for Exports

The popular notion is, more export and less import is best for a country. The reality however is, they need to balance each other. By importing, we give the exporter our currency to buy from us.

Bad loans are thought to help increase the donor country's exports by giving the beneficiary money to buy goods from the donor. At the end of the day, since you got the money back, you essentially gave away the goods for free. How does that make a country richer? It only makes the exporter rich but at the expense of everyone else who paid the tax which was used to extend the loan with.

Export subsidies are just as bad as bad loans. We are essentially selling something below cost to the foreign buyer.

Thought Bubble:

- What about countries like the Philippines who doesn't use Philippine pesos to buy import goods and services? It uses US$ and US$ are the default global currency for trade. How does that motivate the exporter to buy Philippine products when got paid in $US?

- Also, for the US importer who paid US$, what is his assurance that the exporter will import American goods when it can use US$ to make purchases from any country globally, not just the US?

- Additionally, if the exporter was paid in PHP, he will buy what he needs at the cheapest price. If the Philippines doesn't offer him his needs or cannot sell it competitively, then the exporter will likely change those pesos into another currency to make the purchase

Parity Prices

Parity pricing is linking the price of one thing to the price of another. Usually in government, farmers would ask that the selling price of their produce be linked to the price of farm machinery. This assures the farmers that even if the price of their produce goes down, the difference will be subsidized by the government (through limiting production or discarding output) so that their purchasing power remains the same - they could still buy the farm machinery.

This in effect, subsidizes the farmers, protecting them in price from any price drop - a special treatment at the expense of everyone else. Why should they be given special treatment? What about other industries? Additionally, parity-pricing does not factor-in increase in production output through the years and the decrease in industrial machinery as a result of improved technology and economies of scale.

Increased farm prices mean increased expense for the consumer. The latter will be able to buy less with his money. If the parity is brought about by decreased production, then there is a net loss in wealth because the economy will not produce what it can - not full production. If there is an over supply, there might be a forced destruction of what has already been produced - e.g. coffee burning in Brazil.

A more refined defense of parity pricing is to cite tariff on imported products of industry which penalizes the farmer. Thus, parity-pricing evens things up for the farmer. According to Haslitt, neither offsets the other. They only create advantages to involved industries at the expense of the taxpayer. The best approach is to eliminate altogether, parity-pricing and tariff imposition.

Saving the X Industry

This is as far as I've come....there's more...a lot more to read which I'll be adding to here.

Ending Thoughts

Henry Hazlitt's book unveils the curtains and clears the cobwebs to explain very clearly in simple terms, by way of everyday examples, the reality behind government spending and your money. This gives you a cornerstone to anchor you whenever the pundits, politicians, lobbyists, editorialists try to influence your thinking into their agenda. You may never see the world around you the same way again. This book is an eye-opener and a must read!

--- TheLoneRider

YOGA by Gigit ![]() |

Learn English

|

Learn English ![]() |

Travel like a Nomad

|

Travel like a Nomad ![]() |

Donation Bank

|

Donation Bank ![]()

»» next story: Envisioning a Utopian Shangrila

»» next Book Review story: Arahattamagga Arahattaphala - the path to Aranhantship

»» back to Book Review

»» back to Homepage

ARCHIVE 2025:

JAN |

FEB |

MAR

1970 |

1973 |

1975 |

1976 |

1979 |

1981 |

1996 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

ALL BLOGS